Effective borrowing cost calculator

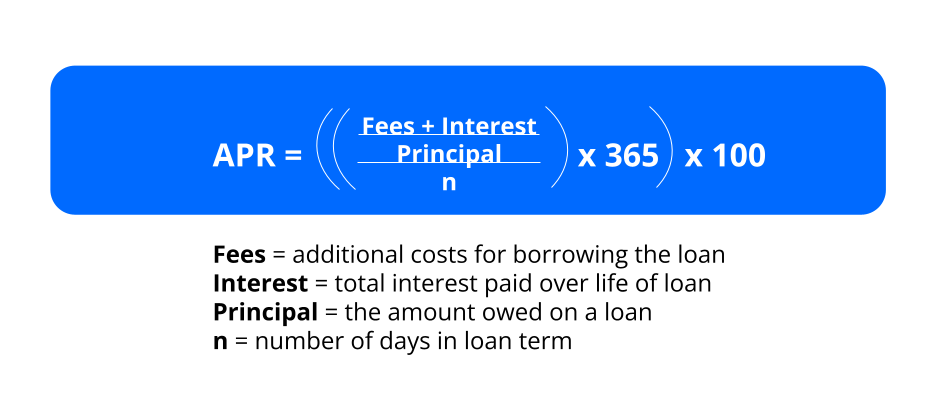

The effective cost that this calculator shows is a good indicator of overall cost of loan and this can be used when comparing loan offers from different lenders. First find the total finance charges by adding all of the interest charged over the life of the loan to other fees.

Top 10 Tips For Buying An Investment Property Buying Investment Property Investment Property Investing

If you borrow a.

. The monthly fees increased till 22 37. Monthly effective rate will be equal to 16968. What rule can one apply to determine if a settlement closing cost should be included in the.

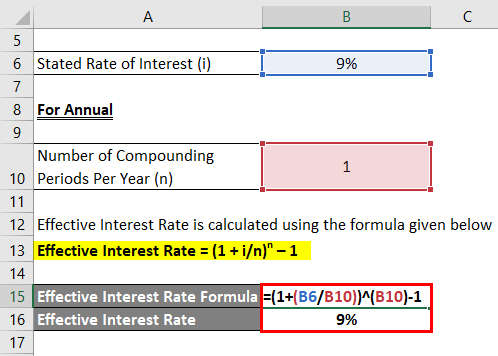

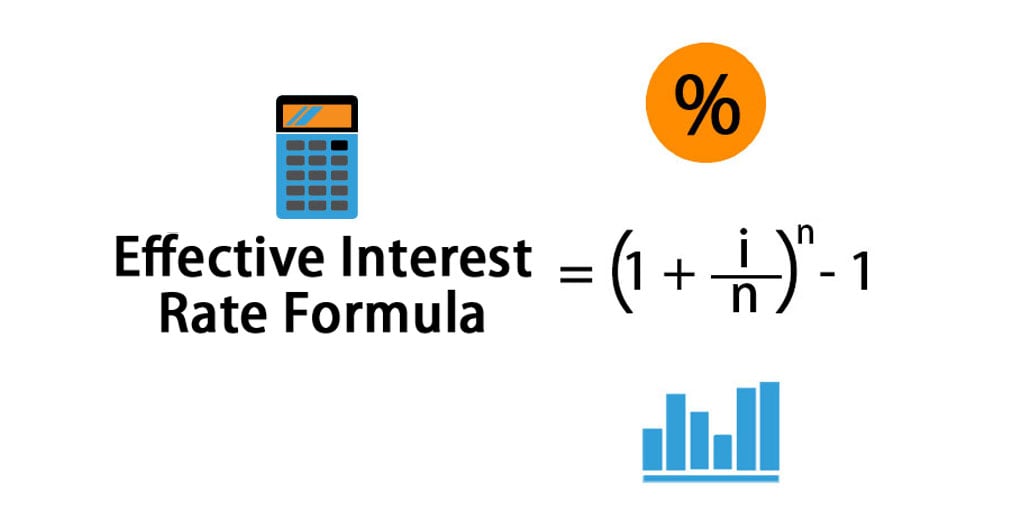

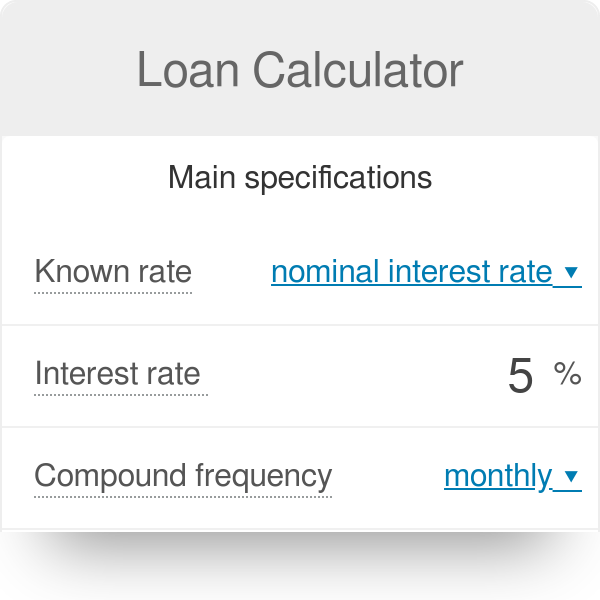

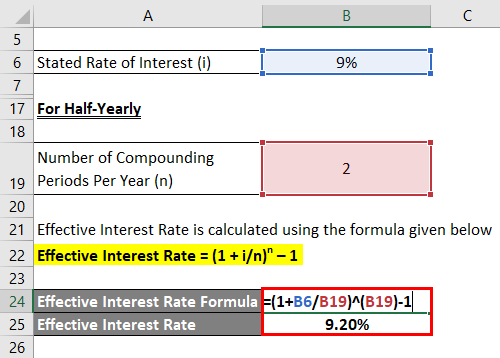

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. It is the amount that you pay over and above the principal amount of a loan borrowed. Effective Interest Rate is calculated using the formula given below Effective Interest Rate 1.

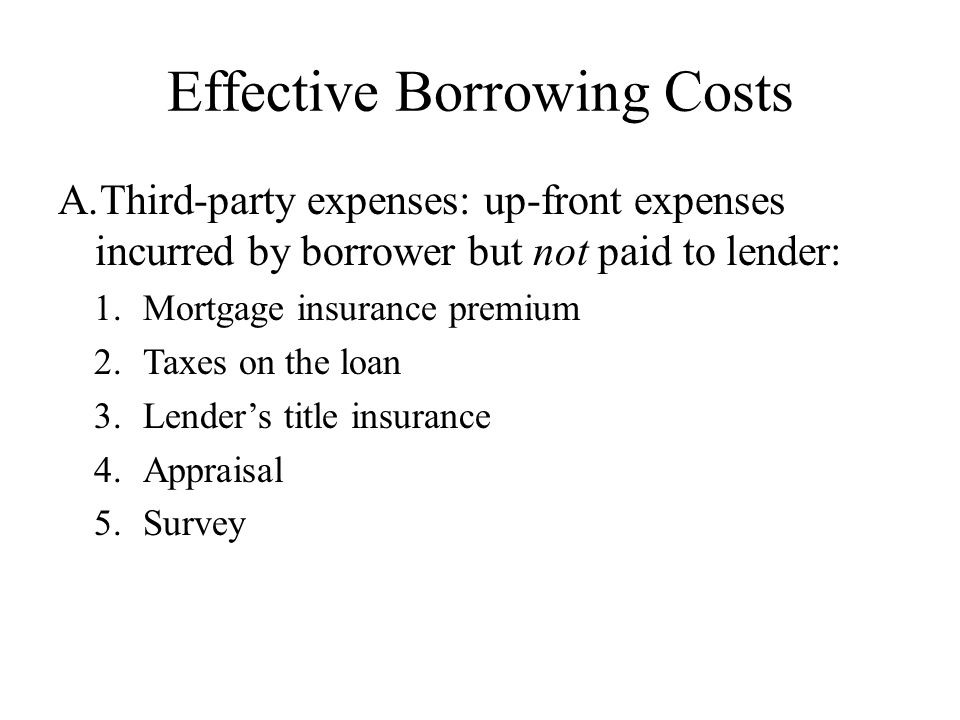

Type into the personal loan calculator the Loan. This problem has been solved. When clients borrow money they incur both financial and transaction costs.

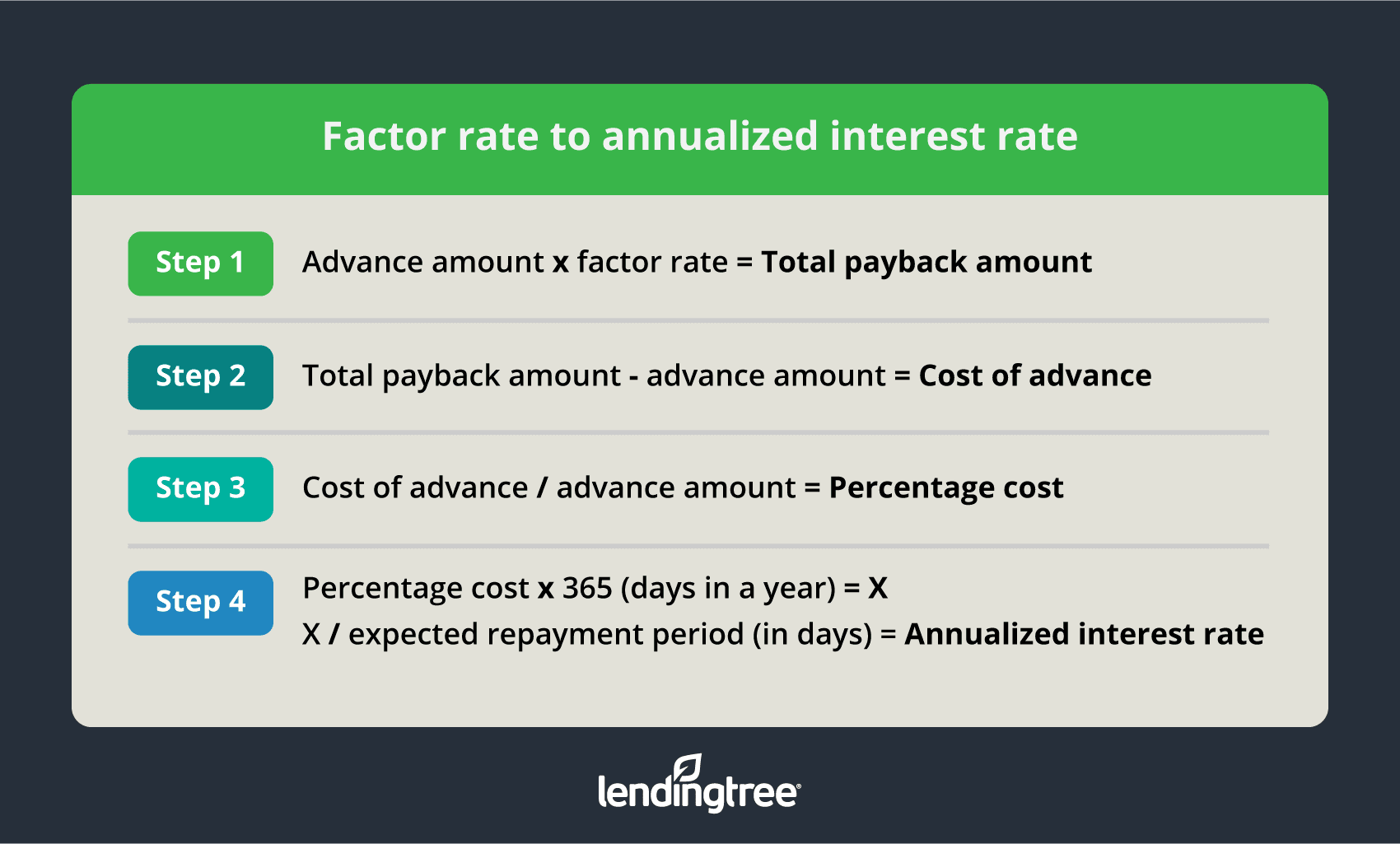

You can calculate an estimate of effective cost using a fairly simple formula. Financial costs include interest fees forced savings group. Show with a financial calculator.

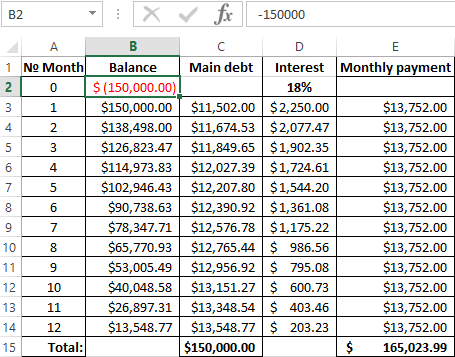

If your borrowed total is. To Use the online Loan Calculator 1 simply. Loan Fees and Effective Borrowing Cost Using the same 200000 loan calculate the effective interest rate to the borrowerwhich is yield or.

Give some examples of up-front financing costs associated with residential mortgages. Use this calculator to find out how much a loan will really cost you. The formula to calculate simple interest is.

The nominal percent is 16968 12 is 203616. Taking an investment loan min. Effective Interest Rate is calculated using the formula given below Effective Interest Rate 1 inn 1 Effective Interest Rate 1 102 2 1 Effective Interest Rate 1025 Therefore.

How to use our calculator Choose how much you want to save or. The cost of borrowing can be stated in nominal terms or in real terms. Interest Deductibility and Cost of Borrowing Calculator Use this calculator to estimate interest deductions and cost of borrowing savings.

Use this calculator to estimate interest deductions and cost of borrowing savings. The number of points you have works to determine your effective loan amount as well as your effective monthly payment but usually only by a small amount. But in the loan.

Borrowing and savings calculator Use our interest rate calculator to see how interest rates affect borrowing and saving. EFFECTIVE COST OF BORROWING Objectives. Given the following information calculate the effective borrowing cost EBC.

Principal x rate x time interest with time being the number of days borrowed divided by the number of days in a year. The effective annual rate is.

What Is Annual Percentage Rate Apr Zillow

Pin On Building Credit

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Effective Interest Rate Formula Calculator With Excel Template

How To Calculate Effective Interest Rate 8 Steps With Pictures

Lender S Yield Borrower S Effective Borrowing Costs Apr Youtube

What Is A Factor Rate And How Do You Calculate It

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Effective Interest Rate Formula Calculator With Excel Template

Calculation Of The Effective Interest Rate On Loan In Excel

Loan Calculator

Here S An Overview Of The Education Loan Process Education Free Education Loan

Coming Soon Png Transparent Images Just Listed Banner Png Image With Transparent Background Png Free Png Images Transparent Background Earth For Kids Transparent

Practical Approach To The Incremental Borrowing Rate For Lease Accounting

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Effective Interest Rate Formula Calculator With Excel Template